2) Capacity overview

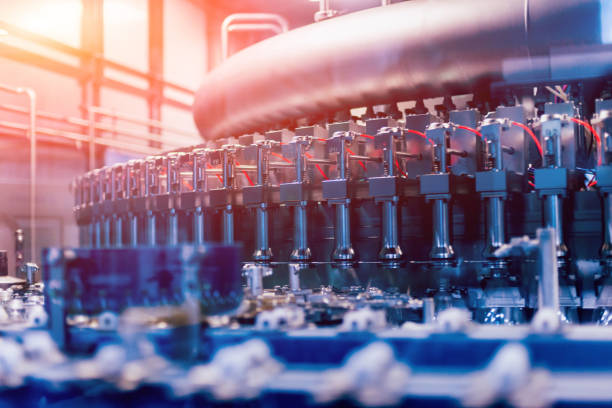

Figure 7: Production Capacity and Operating efficiency of plastics, Fy13

India has a ~2.9 MnTPA of PE production capacity out of which 1.6 MnTPA is HDPE

capacity, 1 MnTPA is LLDPE and rest is LDPE capacity. PP and PVC also have the large

production capacities, i.e., 3.7 MnTPA and 1.3 MnTPA respectively. PVC is one of the

major products where capacity growth in past had been significantly lagging demand

growth.

India has a ~400,000 TPA production capacity of PS and EPS. However, all these

facilities are based on imported styrene since there is no local production of Styrene. In

case of Engineering Plastics, there is a significant opportunity in India. Currently for

Source : Industry reports, Analysis by Tata Strategic

125%

100%

75%

50%

25%

0%

3,600

3,000

2,400

1,800

1,200

600

-

PE PP PVC PS

Capacity Operating Efficiency

Knowledge &

Strategy Partner

12

A report on

Plastics Industry

ABS India has a 100,000 TPA production capacity, while PC base resins are all imported.

Polyamides have a limited production capacity, while other major engineering plastics

are being mostly imported to cater the domestic demand.

Reliance Industries Ltd. (RIL) is the largest producer of commodity plastics in India. It

has 1.16 Mn Tonnes per annum (TPA) capacity of PE, 2.7 MnTPA capacity of PP and

650,000 TPA capacity of PVC (Refer Table 2). RIL's production facilities are located in

Gujarat and Maharashtra. RIL is the only producer of LDPE in India.

Haldia Petrochemicals Ltd. (HPL) is another key player with PE capacity of 710,000 TPA

and PP capacity of 390,000 TPA. HPL's Plants are located in eastern region of India.

Other major players are Indian Oil (IOCL) & Gas Authority of India (GAIL) with their

plants located at Panipat and Auraiya respectively. These plants mainly cater to the

northern regional demand of plastics. IOCL have 650,000 TPA production capacities of

PE and 600,000 TPA of PP, while GAIL has 505,000 TPA capacity of PE.

India has significant production capacity of Plastics. Polyethylene (PE) continues to be

the largest commodity with LLDPE experiencing the fastest growth in this category.

Current polymer capacities are mostly under-utilized with an operating efficiency

varying from 66%-86%, expect for PVC, where production matches with capacity (Refer

Figure 7).

Table 2: Production Capacity of plastics by major players, FY13

Producer PE PP PVC Others

RIL 1,165,000 2,700,000 650,000 -

IOCL 650,000 600,000 - -

GAIL 505,000 - - -

HPL 710,000 390,000 - -

Chemplast Sanmar - - 250,000 -

Finolex - -

270,000 -

Supreme - - 272,000

Ineos ABS - - - 60,000

Source: Plastindia, Analysis by Tata Strategic

A report on

Plastics Industry

Knowledge &

Strategy Partner

13

In downstream plastic processing, India has over 23,000 processing units. Total

Machines installed for plastic processing were 98,000 in FY13. The total processing

capacity has increased to 30 .0 MnTPA in 2013 from 11.7 MnTPA in 2006.

In Northern India, IOCL and GAIL are the two plastic producers with plastic production

capacity of 1.25 MnTPA and 0.5MnTPA. Indian Oil Corporation Limited (IOCL) is the

largest oil company in India in terms of revenues. It is promoted by the Government of

India with Government holding 79% shares. IOCL commissioned its Panipat cracker in

February 2011. The Group owns and operates 10 of India's 20 refineries with a combined

refining capacity of 65.7 MnTPA.

Govt. of India has 57% stake in GAIL. It is a dominant player in natural gas trading

business and uses natural gas as the feedstock for production of ethylene and in turn

produces Polyethylene. GAIL has plans to double its plastic production capacity by

2014. HMEL's Bhatinda Polypropylene plant (0.44MnTPA) was commissioned in 2012.

All put together the plastic production capacity is expected to go up to 2.5MnTPA by

2014-15. The figure below maps the plastic production facilities along with their

capacities.

Availability of ~2.5 MnTPA of plastics in Northern region may result in spur of

investments in downstream plastic processing. Moreover since the north region does

not have access to ports, hence the import/ export potential is restricted because of

additional cost of transportation. This could result in ensuring a self-sufficient demandsupply scenario for the north as the optimal solution.